|

| Source: Yougov Brandindex. Brand rankings for 2016. |

The YouGov Brandindex rankings for 2016 reflect a love affair with local as well as digital brands in Singapore. Singapore Airlines, DBS bank and The Straits Times newspaper are in the list, as well as WhatsApp, and the Apple iPhone in the top three. Other tech brands include Facebook, Google, e-commerce marketplace Qoo10, and YouTube.

Brands were rated using BrandIndex’s Buzz score* which asks respondents, “If you've heard anything about the brand in the last two weeks, through advertising, news or word of mouth, was it positive or negative?”

|

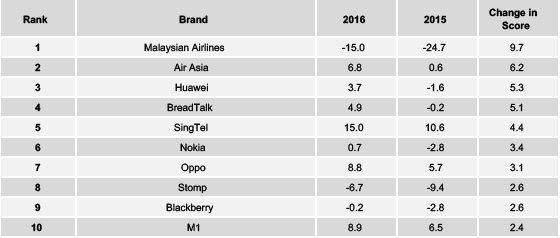

| Source: Yougov Brandindex. Buzz brand ranking improvements from 2015 to 2016. |

The Buzz Improvers chart ranks the brands with the highest increase in Buzz comparing scores in years 2015 and 2016. Both scores are representative of the general population.

The top Buzz improvers were Malaysia Airlines (formerly called Malaysian Airlines), AirAsia and Huawei. Huawei in particular went from negative territory in 2015 to positive digits in 2016, while brand-next-door Malaysia Airlines' rankings are still negative, but doing better. Perception for both Malaysia Airlines and AirAsia were likely affected by planes lost in 2014, and show a long tail effect on brand reputation. While Malaysia Airlines' flight MH370 has yet to be recovered at the time of writing, AirAsia did go from a low positive score in 2015 to a much higher one in 2016, showing it is possible to rebound.

Other highlights included:

+Quick service (QSR) restaurants and casual dining brands were all US brands, McDonald's, Starbucks and Subway. Bakery BreadTalk, McDonald's and local eatery EAT did best on Buzz improvements. In 2015 BreadTalk was caught repackaging another brand's prepackaged soy milk as its own home-made product, causing consumer unhappiness. This followed on from the bakery introducing a new "commemorative bun" while the nation was coming to terms with the death of Singapore founding father Lee Kuan Yew in March 2015. The product's name was a pun on the Lee family name, and proceeds were to go to charity.

+In the area of finance, DBS, DBS subsidiary POSB Bank and OCBC won out. Paypal, UBS and IG Markets made the most gains in Buzz, UBS and IG Markets from low positive scores. For insurance, NTUC Income, Prudential and Great Eastern are in the lead. Etiqa, Tenet Sompo - whose parent company comes from Japan - and Zurich Life made the most gains, all from low positive scores.

+For social media, Singapore prefers WhatsApp, Facebook and YouTube. 'Other' Internet brands Google, LinkedIn, MSN and KakaoTalk were the Buzz improvement winners for the year. LinkedIn is 5th in the top five social media brands, whereas MSN and KakaoTalk made modest gains over smaller Buzz scores. Yahoo and Jobstreet were in the top three. Fastjobs, Baidu and Craigslist are the top Buzz improvers for the year. Baidu and Craigslist are still in negative territory however.

+The mobile space was a clean sweep for Apple with Apple's iPhone, Apple and the Apple iPad being the three brands named. Huawei, Nokia and OPPO demonstrated the most Buzz improvement, while Blackberry and Motorola came in at 4th and 5th on the Buzz improvement list gonig from more negative scores to nearly positive scores.

+News had its own Brandindex category in Singapore. Daily The Straits Times, Mediacorp's regional broadcaster Channel NewsAsia and Mediacorp's Today newspaper were in the top three, while online community Stomp, business publication The Edge and free Tamil language daily Tabla! made the most improvements in Buzz. Stomp and Tabla! are also owned by the same parent company as The Straits Times, Singapore Press Holdings.

+The fashion retailers list saw single-brand fashion retailers H&M, Uniqlo, and G2000 as the best known brands. Bershka saw a jump in Buzz gains.

+Airlines for travel that were the most well-known included Singapore Airlines, Emirates and Cathay Pacific. Malaysia Airlines, Air Asia and Air China did best on Buzz improvement. While Malaysia Airlines did best, it is still in negative territory whereas Air Asia went from negative to much more positive scoring. Air China and China Eastern Airlines made improvements but Buzz scores remained negative.

+Singapore hotels ironically included Airbnb as the lead brand, although it is an e-marketplace for private property. Shangri-La and Fullerton rounded out the top three. Hilton made the the most Buzz improvements for 2016. In December 2015 the false ceiling above the driveway at the hotel collapsed, damaging cars and sending people to hospital; the negative associations carried over to 2016.

+The e-commerce/m-commerce category saw e-marketplaces Qoo10 and Carousell followed by global e-marketplace Amazon take the lead. Amazon is not actually in Singapore, although it had announced plans to enter the market in Q117. It was later announced that the launch would be postponed. Lazada, e-supermarket Redmart and Hipvan grew in popularity over the last year. Lazada's 2016 score is lower than that for fashion e-tailer Zalora and Groupon - bought by Fave in March 2017 - which came in fourth and fifth place respectively.

*All Buzz scores listed have been rounded to a single decimal place; additional precision was used internally to assign ranks.