|

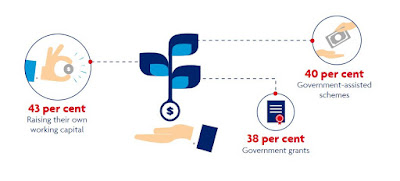

| Source: UOB infographic. Statistics gathered from the Financing for Startups and Small Businesses Survey. |

According to the Financing for Startups and Small Businesses Survey* by United Overseas Bank (UOB), the majority of startups and small businesses in Singapore do not understand fully the range of alternative funding options available for their early expansion needs. They are also unclear about how to employ most effectively these options which include venture capital, venture debt, and debt and equity crowdfunding.

Mervyn Koh, MD and Country Head of Business Banking, Singapore, UOB, said that funding is a key factor for business expansion and it is important that startups and small businesses are able to differentiate between the funding options that are available to help them scale up their businesses in the early stages of growth.

“While established companies are able to access funding through conventional methods such as bank loans and working capital, startups typically are not able to raise the funds needed as easily. This is because they are still developing their concepts, products and services into viable business models, and as such may not have consistent cash flow to qualify for traditional loans,” said Koh.

The startups and small businesses surveyed said that they did not know where to turn to obtain advice on the range of funding options available (65%). They also felt that the eligibility criteria for these options were unclear (62%) which made it difficult for them to know if they are eligible. These are in contrast to the straightforward manner of receiving guidance by banks on traditional financing methods.

As a result of their unfamiliarity with financing options, startups and small businesses indicated a preference to rely on the tried and tested funding sources, such as raising their own working capital (43%), government grants (38%) and government-assisted schemes** (40%), for their business expansion.

The survey also found that the respondents were unfamiliar with the distinctive features of each of the alternative funding options. For example, on venture debt, respondents thought that investors needed to be involved in making business decisions (34%). In fact, it is not required for this option. As for debt crowdfunding, one in four small businesses said that there was no interest payable on the crowdsourced funds. This is a misconception as funds raised through debt crowdfunding do attract an interest on the funded amount. In addition, 23% of businesses polled believed that they would have to give up equity in their business for the crowdsourced debt. In reality, debt crowdfunding does not involve giving up equity.

“Additional funding is a lifeline for startups and small businesses that often face the challenge of tight cash flow. However, we find that most of the time, they need more education on what these options are and how they can be used for their business. To understand better the best financing option for their business, they should seek professional advice, either from government bodies, accelerators or other organisations in the funding ecosystem such as venture capital firms and financial institutions. With a clear understanding of the various funding options available, they could realise their growth potential more quickly ,” said Koh.

To meet the funding needs of startups and businesses across all growth stages, UOB, which banks one in every two small businesses in Singapore, offers end-to-end solutions including equity crowdfunding and venture debt through OurCrowd and InnoVen Capital respectively. UOB also provides mentorship and guidance to startups and small businesses on their business model and the various funding options available through its innovation lab, The FinLab. The bank has also trained its commercial bankers to provide clients with the most up-to-date information on alternative funding channels beyond traditional financing.

In addition, UOB is creating a “how-to” guide that explains the type of funding options available for startups and small businesses and how these can be easily accessed.

Interested?

Look for the guide on the UOB Asian Enterpriseswebsite. It will be available in December

View the complete Financing for Startups and Small Businesses Survey infographic (PDF)

*The survey was conducted by UOB in October and November 2016 among 250 Singapore-based companies with an annual turnover of under S$30 million. The objective was to understand if startups and small businesses understood the range of financing options available to them.

**This refers to schemes such as SPRING’s Local Enterprise Financing Scheme.