In 2015, unemployment remained low in Singapore, says the

Ministry of Manpower (MOM). Unemployment has remained low, the ministry said in a statement, despite the slowdown in local employment

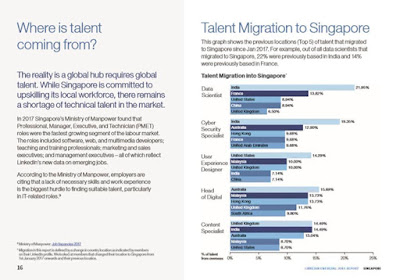

growth.

Employment

|

| Source: MOM website. Figure 1: Local employment change. |

Unemployment has remained low and stable since 2011

The unemployment rate for residents in 2015 was 2.8% (up from 2.7% in 2014), while

that for citizens remained unchanged at 2.9%.

Total employment growth has moderated

Total employment growth has moderated amidst weaker economic conditions, slower local

workforce growth

and tightened supply of foreign manpower. Excluding Foreign Domestic Workers (FDWs), total foreign manpower employment

grew by 23,300

(0.7%)

in

2015, lower than the

122,100 (3.7%) growth in 2014 and the

131,300 (4.2%)

growth in 2013.

Employment of locals was flat

Employment of locals

1 was flat after high growth in

2013 and

2014. Local employment growth

(net increase of

700 or 0%) moderated

significantly

after exceptionally

high

growth in

2013

and

2014

(96,000 or 4.4% in 2014

,

82,900 or 4% in 2013).

The moderation

reflects a confluence of structural

and cyclical factors. Structurally, MOM is starting to see the effects of slowing local workforce growth.

The

strong local employment growth

to meet labour demand in the earlier years

was

supported by

continued increases in the

size of our

working-age population, as well as gains in

the

resident labour force participation rate (LFPR)

with

more women and older residents

joining

the

labour force.

However, these effects

are expected to

taper

significantly in the medium term

due to our demographic realities.

Growth of the

working-age local population is slowing

This is due to the

shrinking

size of

successive cohorts

of younger locals

entering

the workforce,

and

more

from the “baby boomer” cohorts retiring and exiting the workforce. In 2020,

for every one local exiting the working-age cohort, 1.1 locals are expected to enter, down from

1.4

in 2015

2.

The LFPR may not improve much further

At

83.1%

3,

Singapore’s LFPR for residents aged 25

to 64 in 2015 is already higher than that

of the OECD average and that of many economies.

Singapore’s

LFPR

for

resident males

aged 25

to 64 (92.7%)

is among the highest in the world, and the

LFPR

for females

aged 25 to 64

(74.1%)

has been catching up with

that in

developed economies

4.

Even as local employment growth is expected to slow down in the medium term, the moderation was intensified in 2015 due to cyclical weakness in various sectors and the significant net decline of casual workers from the labour force. The slowdown was uneven – local employment declines in some sectors offset local employment growth in other sectors, resulting in the low net overall increase in local employment.

The declines were mainly in externally-oriented sectors such as manufacturing and wholesale trade, and concentrated in the trade-related segments. Real estate services, amid the lacklustre property market, and retail trade, with a slowdown in the increase in new retail space available in 2015 and a decline in retail sales (excluding motor vehicles) volume, were also negatively affected. On the other hand, local employment grew in professional services, financial & insurance services, information & communications, community, social & personal services, and administrative & support services.

Foreign employment growth continues downward

Foreign employment growth (22,600 or 2%, excluding FDWs) has fallen since 2011 (Figure 2), although this was uneven across sectors. The increase in foreign employment was driven primarily by the Services sector, which saw an accelerated pace of foreign workforce growth. Notably, there was a significant increase in the number of work permit holders (WPHs), especially in food & beverage services. In contrast, the number of foreign workers in the marine, process and manufacturing sectors declined amid low oil prices and weak external demand.

Income

Singaporeans' income is up

Median income grew for citizens in 2015. The nominal median monthly income from work of full-time employed citizens (including employer CPF contributions) rose by 6.5% over the year to S$3,798 in June 2015, or 7% in real terms5.

There has been a sustained rise in income at the median and 20th percentile over the last five years. The median income (including employer CPF contributions) of full-time employed citizens rose by 32% (5.6% p.a.) in nominal terms from 2010 to 2015, or 16% (3.% p.a.) after adjusting for inflation. Amid on-going initiatives to boost income of low-wage workers, income at the 20th percentile of full-time employed citizens rose by a comparable 31% (5.5% p.a.) in nominal terms, or 16% (2.9% p.a.) in real terms, over the same period.

Redundancy and workforce re-entry6

Redundancies have continued upward since 2010, with a decline in re-entry rates

A total of 15,580 workers were laid off in 2015, up from 12,930 in 2014, and the highest since the global financial crisis in 2009. The increase in redundancies was accompanied by a decline in the rate of re-entry into employment among workers made redundant7, with both trends reflecting the weaker economic conditions in 2015.

Sectoral outlook

Construction

Total employment growth in the construction sector continued to slow in 2015 (8,600) as compared to previous years (14,300 in 2014, 35,200 in 2013). The slowdown in employment growth was largely due to a moderation in output growth.

Manufacturing

Amid weak external demand, total employment in the manufacturing sector fell in 2015, the bulk of which was due to a decline in the number of foreign workers. Value-added manufacturing shrank by 5.2% in 2015 (a reversal from the 2.7% expansion in 2014), driven largely by a contraction in the transport engineering cluster (in turn largely due to weakness in the marine & offshore segment).

For this year, the employment outlook for the manufacturing sector remains soft. In particular, hiring demand in the marine and offshore segment is expected to be weak. Lower oil prices have weakened the prospects for new rig orders for firms in the marine and offshore segment, and increased the risks of further deferments and cancellations of existing orders. In addition, there could also be negative spillover effects on firms in the precision engineering cluster that support the oil and gas industry.

Services

Services accounted for most of the employment growth in 2015, although growth has slowed compared to 2014. Total employment (excluding FDWs) in this sector increased by 36,500 over the year (compared to 111,700 in 2014). Productivity declined in sub-sectors such as accommodation & food services and transportation & storage, but increased in the wholesale & retail trade and finance & insurance sectors.

Overall employment growth this year is expected to be supported by the Services sector. In particular, the domestic-oriented services sectors are expected to remain a major contributor to employment growth. Sectors such as community, social & personal services should continue to see firm demand for manpower, especially in the healthcare segment.

2016 outlook

In line with the Ministry of Trade and Industry’s (MTI) projected GDP growth of 1% to 3%, MOM expects labour demand to be modest in 2016. MOM expects redundancies to continue to rise in sectors facing weak external demand and that are undergoing restructuring. On the other hand, domestic-oriented services sectors such as community, social & personal services and food & beverage services are expected to continue to demand labour.

Wages are also expected to rise at a "more moderate pace" compared to 2015, while consolidation and exits of businesses are also expected given the economic conditions.

Foo See Yang, Vice President and Country General Manager of

Kelly Services Singapore, commented that the results from MOM’s 2015

Market Labour Report are in line with the current economic situation of slow total employment growth in 2015. "Despite growth for the third consecutive quarter in 2015 at 0.9%, this is much lower than the 3% to 4% growth levels seen in 2011 through 2014. With the new normal being a slowing economy, Kelly Services expects companies in Singapore to continue to take a cautious approach to hiring for the rest of the year," said Foo.

"Amid the uncertain economic backdrop and as the Singapore economy continues to restructure and adopt a manpower-lean mentality, we are observing a growing number of our clients adapting by hiring contract and free agent talent, even at managerial and senior levels. This concept, known as talent supply chain management, integrates contract and free agent talent into hiring strategies which allows companies to stay flexible to meet their short-term business objectives, maximise the use of their resources while also planning for the long-term. In addition, it is critical that companies adopt a contract-friendly culture and policies that allow for career growth and progression for their contract employees.

"Similarly, talent will need to shift their mind-sets and embrace contract roles with a continued tight labour market and job vacancies on the decline. Individuals will need to ensure they have the desired skills for the jobs that are available. With this year’s budget predicted to be more focused on supporting the greater economy, individuals should continue to take initiative to upskill and leverage the available SkillsFuture funds the government is currently offering."

Foo added that contract and free-agent work arrangements are in line with the findings from the most recent

Kelly Services Global Workforce Index (KGWI), which shows that workplace flexibility is increasingly important for talent of all generations.

Interested?

Read the

WorkSmart Asia blog post about

Kelly Services Global Workforce Index findings for the Asia Pacific region

1 Refers to Singaporeans and permanent residents.

2 Data from the Singapore Department of Statistics

3 LFPR statistics are from Labour Force in Singapore, June 20154 A detailed analysis is available in an annex to MOM’s Statement on Labour Market Developments (March 2015) (PDF)

5 Gross monthly income data are from the Labour Market Report, 2015, MOM

6 Data on redundancy and re-entry into employment are from the Labour Market Report, 2015, MOM

7 This refers to workers made redundant in Q315, who secured re-employment by December 2015.