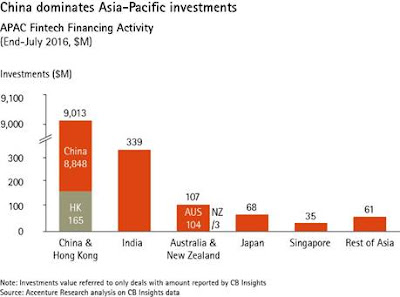

Investments in Asia-Pacific financial technology (fintech) ventures, primarily in China, reached US$9.62 billion as of July 31, more than twice the US$4.26 billion invested in the region in all of 2015, according to Accenture.

An analysis of CB Insights data also showed that investments in Asia-Pacific have eclipsed North America, which as of July 31 garnered US$4.58 billion in fintech investments; and also tops Europe, which attracted US$1.85 billion in the same period.

By deal volume however North America and Europe, show more activity as the Asia-Pacific increase is due to big investments in a few select fintech companies in China, Accenture said. There have been 192 deals in the Asia-Pacific region so far this year, as compared with 509 in North America and 230 in Europe.

In fact, the top 10 investments in Asia-Pacific fintech ventures occurred in mainland China and Hong Kong, accounting for 90% of overall Asia-Pacific investments and valued at US$8.75 billion. In total, China and Hong Kong fintech ventures have attracted US$9 billion in investments to date in 2016.

“China’s established companies, rather than nascent startups, are at the forefront of the fintech trend in the region,” said Beat Monnerat, Accenture Senior MD, Financial Services Asia-Pacific. “Fintech companies with major backers such as Alibaba and JD.com are focused on providing positive end-to-end customer experiences, which includes payments and lending. This is transforming China’s financial services industry and is consistent with the global ‘Fourth Industrial Revolution’, which is bringing innovation from non-traditional competitors to the financial services industry.”

Ant Financial Services Group, the financial-services affiliate of e-commerce giant Alibaba Group Holding that operates China’s online-payments platform Alipay, closed a US$4.5 billion fundraising round in April. Ping An-backed Lufax, which is now using the name Lu.com, completed a US$1.2 billion round of fundraising in January. In that same month, China’s second largest e-commerce company, JD.com, raised US$1 billion in new funding for its consumer finance subsidiary, JD Finance.

In recent years, major Alibaba affiliates and China’s biggest social network company, Tencent, have also invested in other smaller startups, such as Fenqile, a micro-loan site which literally means “happy instalments,” Qufenqi, an electronics retailer that lets buyers pay in monthly instalments, and India’s One97 Communications, a mobile Internet company.

“The fintech trend in China continues to skew toward online payments and lending, including peer-to-peer (P2P), which is creating market-share dilution for banks,” said Albert Chan, MD, financial services for China, Accenture. “China’s banks, whether building their own competitive platforms or not, should consider investing in collaborative fintech ventures in order to remain competitive.”