A global survey* of more than 8,000 travellers has uncovered a growing appetite for overseas travel despite rising living costs.

|

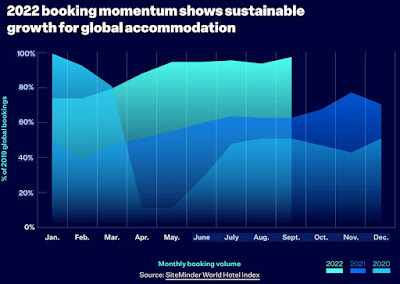

| Source: SiteMinder Changing Traveller Report 2022. Global accommodation momentum from 2020 to 2022. |

The report uncovered five travel trends:

- Macro-travel: The urge to travel is stronger than rising inflation

- Digital influence: Right now, travellers are the most winnable consumers on earth

- Bleisure: Working travellers want the hotel of the future, today

- Trust: Every digital touchpoint matters for the new trust-critical traveller

- Human connection: Tech-enabled travellers are not willing to compromise on human connection

Across the four countries polled in Asia Pacific, 71% of travellers in China and 56% in both Indonesia and Thailand (Australia 65%), said that inflation had “no impact” to “moderate impact” in their decision when planning and evaluating the cost of travel. Respondents who cited a “moderate impact” also stated that cheap accommodation rates were not the most important factor when booking their travel.

The annual Changing Traveller Report 2022 by SiteMinder, the global hotel commerce platform, also found that about half of respondents – 48% of travellers in China and Thailand and 52% of travellers in Indonesia – intend to travel “internationally or domestically” over the next 12 months. In contrast, 85% of Australia travellers plan to do the same.

Millennials (those aged 26 to 41) form the largest segment who plan to travel, accounting for 58% of travellers in Indonesia, followed by 56% in China and 52% in Thailand.

As the largest accommodation-specific traveller survey globally, insights from SiteMinder’s 2022 Changing Traveller Report showed that:

Gen Z (aged 18-25) are also the most likely to be influenced by the social media presence of the property they book, compared to other age groups. Thai travellers are the most influenced by social media, with 78% of respondents saying they are “very influenced” or “influenced” by the property’s social media presence in their booking decision, followed by 75% in China and 74% in Indonesia. In fact, respondents in every age group agreed that they are all influenced by the social media accounts of the accommodation they book.

Bleisure - combining business with leisure - continues to be a growing trend, with 49% of Gen Z global travellers most likely to take a working holiday, followed by 46% of Millennials. Nearly two in three (65%) Thai travellers top the bleisure travel trend, followed by 62% of Indonesia travellers and 47% of Chinese travellers. In fact, roughly a quarter or more of travellers from every country surveyed in the report will be bleisure travellers on their next trip. For Australia, 24% of travellers intend to be bleisure travellers.

Travellers are likely to change their perception of the accommodation provider if they have a negative customer experience when accessing and using the accommodation provider website, for example if the website is slow, or the payment process is not secure. At least seven in 10 Asian travellers – 89% in China, 72% in Indonesia and 75% in Thailand – said they are “very likely” or “likely” to change their perception when the accommodation provider was not using technology effectively. Nearly six in 10 Australia respondents (59%), in contrast, said the same.

The use of artificial intelligence (AI) and robots by accommodation providers to replace hospitality professionals is also well accepted with 86% of travellers in China, 85% of travellers in Thailand and 76% of travellers in Indonesia saying they are “very supportive” or “supportive” of accommodation providers using AI and robots to automate previous human work processes. For Australia, 31% of travellers are very supportive or supportive.

Sankar Narayan, MD and CEO of SiteMinder, said, “We can see that optimism is returning from travellers to the tourism sector, and there is demand for travel as travel restrictions and health concerns abate across the world. Despite inflation and rising costs, travellers are reporting they are undeterred and do not intend to cancel their travel plans, which is a positive sign for accommodation industry resilience and travel globally, particularly in Asia.

“The long-awaited recovery of travel has also emerged with a new type of traveller, who has higher expectations from hotels and their travel experiences than ever. We can see that, more than ever, travellers now have ambitions to book, travel, work, connect, and experience the world with the greatest flexibility and security possible.”

ExploreVisit the SiteMinder interactive hotel experience.

*Powered by Kantar, the SiteMinder survey of 8,182 travellers aged over 18 years spanned Australia, China, France, Germany, Indonesia, Italy, Spain, Thailand, the UK, and US. The survey, conducted in August 2022, included 2,461 travellers in China, Indonesia and Thailand. Respondents were asked 25 accommodation-specific questions, and were split up by gender, generation, location (urban, suburban, rural), travel plans, work plans and the type of accommodation they intended to next stay in. The data was supplemented with reports and data from McKinsey & Company, Deloitte, Paysafe, and others.