|

| Source: CrescentRating website. Cover for the Mastercard-CrescentRating Digital Muslim Travel Report 2018. |

In 2017, CrescentRating found that Muslim Millennials rely very heavily on social media and online reviews for travel; travel two to five times annually, and look for halal food and prayer tools online - behaviours condensed into the pillars accessibility, affordability and authenticity.

Unveiled at the Halal-In-Travel Asia Summit, the Mastercard-CrescentRating Digital Muslim Travel Report 2018 (DMTR2018) has revealed what shapes the growth of online purchases by the next generation of Muslim travellers. The research projects that online travel expenditure by Muslim travellers will exceed US$180 billion by 2026.

The DMTR2018 is the first comprehensive report looking at the online travel patterns and attitudes of Muslim travellers across different demographic groups. It extends the research on the digital Muslim traveller population, expanding beyond the Muslim Millennial traveller (MMT) segment which was studied last year in the Muslim Millennial Travel Report 2017, and also analyses travellers along the continuum of strictly practising, "less practising" and practising travellers.

Fazal Bahardeen, CEO of CrescentRating and HalalTrip, said “The DMTR2018 reveals important online behaviour and preferences of Muslim travellers. It will equip tourism destinations, tour operators, airlines and other tourism and hospitality stakeholders with insights of online platforms and social networking services to evaluate the potential within the Muslim market.

“With the rapid proliferation of enabling online technologies and payment methods and the rise of Muslim digital natives, as a major segment within the Muslim travel market, the outlook for the digital space is very positive. Destinations need to ensure that their messages reach Muslim travellers through online channels. This report gives the industry a practical and ready segmentation criterion to empathise with different demographics. Digital is real and transcends generations.”

Key takeaways from the DMTR2018 included:

- Digital is real and transcends generations

Different generations are using digital, though they behave differently, Zaini said.

- Content is key.

"You have to focus on all segments, and not just Muslim Millennial travellers," Zaini noted.

- A mix of online platforms are used per product or service journey

"The impact on business is that you need to be agile enough to appropriately display your content, be it desktop or mobile, and be smart enough to understand what users are looking for," she said.

"Mastercard works with likeminded partners to create tailored offerings for customers across a wide range of passion points. As consumers explore more countries and regions, Mastercard is also seeing an increase in the use of cashless and digital payments through prepaid and debit options as a safer, more convenient and reliable form of electronic payments for greater peace of mind when travelling.”

"We are collaborating with banks and others to create a safer experience across all touch points," he added.

|

| Online travel purchases will be worth US$180 billion in 2026. |

|

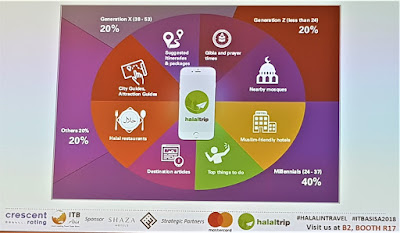

| Muslim Millennials go online to plan their trips, accounting for 40% of all Muslim traveller transactions, but Gen X and Gen Z as well as Baby Boomers (listed as Others) are also digital users. |

The Mastercard-CrescentRating Global Muslim Travel Index (GMTI) 2018, released in April this year, confirmed that the Muslim travel market will continue its fast-paced growth to reach US$220 billion in 2020 and US$300 billion by 2026. In 2017, there was an estimated 131 million Muslim visitor arrivals globally. CrescentRating research indicates that more than 60% of Muslim travellers were either Millennials or Gen Z.

The GMTI 2018 found that 30 Muslim outbound markets** represent 90% of the overall Muslim visitor arrivals and should be the focus of the travel industry. This study looked at the “digitally enabled” environment of these markets to understand the potential of digital transactions. These destinations have been divided into distinctive clusters based on the market size and digital access.

Cluster

A

Large outbound markets with

a high level of digital enablement |

|

These are regions with large Muslim populations and high per-capita GDP, allowing a high percentage of travellers to travel internationally. The majority of the residents in these countries are digital-savvy and have the latest digital infrastructures. |

Cluster

B

High

level of digital enablement but smaller outbound markets

|

OIC

countries

Non-OIC

countries

|

These

are countries with residents who are digital-savvy and have the

latest digital landscapes but their populations are smaller in

comparison to those in Cluster A.

|

Cluster

C

Good level of digital

enablement but smaller outbound markets

|

|

They have good digital infrastructures but the population of Muslim travellers travelling internationally is still small. |

Cluster

D

Emerging growth markets with

fast-growing levels of digital enablement

|

|

These are majority Muslim countries with a growing outbound travel market. Even though they may not have widespread digital infrastructures yet, businesses can look at these markets for medium-to-long term prospects. |

Bahardeen noted that while the markets are diverse, the travellers share values of a common faith and identify as Muslims. That said, they come from different locations, speak multiple languages and dialects, and have differences in cultural lifestyle, plus varying degrees of halal consciousness.

"It is not a homogeneous market. You really have to get an understanding of each of those markets," he said, adding that someone from a more secular country who goes to a strict Muslim country may become stricter during a trip, and vice versa, so there cannot be hard and fast rules on hospitality.

"We have to look at different ways of catering to them," he said.

Explore:

Read the Mastercard-CrescentRating Digital Muslim Travel Report 2018 report

Hashtags: #halalintravel, #itbasia2018

*According to CrescentRating, baby boomers are classed as those born between 1946 and 1964; Generation or Gen Xers were born between 1965 and 1980; Millennials from 1981 to 1996, while Gen Zers were born from 1997 onwards.

**Outbound refers to people from one country going to travel overseas. Inbound refers to the opposite, people from other countries travelling to a particular country.

*According to CrescentRating, baby boomers are classed as those born between 1946 and 1964; Generation or Gen Xers were born between 1965 and 1980; Millennials from 1981 to 1996, while Gen Zers were born from 1997 onwards.

**Outbound refers to people from one country going to travel overseas. Inbound refers to the opposite, people from other countries travelling to a particular country.