Yesterday, it was a promoted tweet on my Twitter timeline, offering a whopping S$100 off for a purchase of S$120 at popular Singapore supermarket chain NTUC. Googling produced a newspaper warning dated some months ago that the discount coupons for NTUC being circulated on Facebook were fake, and NTUC's own Twitter account has confirmed it.

If it sounds too good to be true, it probably is, says Norton by Symantec, which recently released its findings from the Norton Cybersecurity Insights Report.

The report sheds light on what people think about cybercrime today. It found that globally, 62% of consumers believed it is more likely their credit card information will be stolen online compared to only 38% who think it is more likely they will lose credit card information from their wallets. Additionally, 47% reported they have been affected by cybercrime.

In Singapore:

Approximately seven in 10 (69%) Singaporeans believe using public Wi-Fi is riskier than using a public restroom

Seven in 10 consumers think that storing their credit card and banking information in the cloud is riskier than not wearing a seatbelt

More than seven in 10 (71%) consumers believe getting their credit information stolen after shopping online is more likely than having their credit card stolen out of their wallet

“Consumer confidence was rocked in 2014 by an unprecedented number of mega breaches that exposed the identities of millions of people who were simply making routine purchases from well-known retailers,” said Gavin Lowth, Vice President, Norton Consumer and Small Business, Asia Pacific and Japan. “Our findings demonstrate the headlines rattled people’s trust in online activity, but the threat of cybercrime hasn’t led to widespread adoption of simple protection measures people should take to safeguard their information online.”

“Consumer confidence was rocked in 2014 by an unprecedented number of mega breaches that exposed the identities of millions of people who were simply making routine purchases from well-known retailers,” said Gavin Lowth, Vice President, Norton Consumer and Small Business, Asia Pacific and Japan. “Our findings demonstrate the headlines rattled people’s trust in online activity, but the threat of cybercrime hasn’t led to widespread adoption of simple protection measures people should take to safeguard their information online.”Lowth said there were clear generational differences in attitudes. Baby Boomers – a group often considered less tech savvy – report more secure online habits than Millennials. Millennials, born in the digital era, often throw caution to the wind with 33% admitting to sharing passwords and other risky online behaviour.

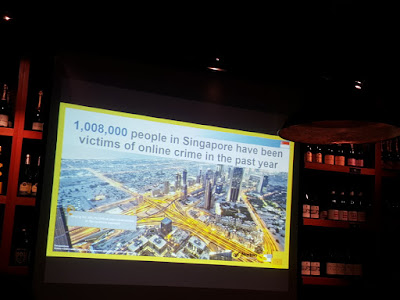

Singapore consumers lost an average of 20 hours over the past year dealing with the fallout of online crime and nearly S$545 per person – totalling roughly S$5.49 billion. On top of this loss, cybercrime took an emotional toll with six in 10 (61%) of consumer cybercrime victims in Singapore feeling frustrated after becoming a victim. Further, in Singapore:

More than eight in 10 (82%) of respondents said they would feel devastated if their personal financial information was compromised

Nearly three-quarters (74%) of respondents believe dealing with the consequences of a stolen identity is more stressful than preparing for a presentation at work (52%)

Nearly seven out of 10 (68%) respondents are more stressed when they realise that they have downloaded a virus than sitting next to a screaming baby on a plane (51%)

Despite concern and awareness of cybercrime, consumers are overconfident in their online security behaviours. When asked to grade their security practices, they consistently award themselves “A”. But in reality, most are not passing the most basic requirement of online security: password use. In Singapore:

Of those using passwords, only three in 10 (29%) respondents always use a secure password – a combination of at least eight letters, numbers and symbols. Worryingly, nearly one in four do not have a password on any device.

People are sharing passwords to online sensitive accounts with friends and family. Of those sharing passwords, almost one in four (23%) share the password to their banking account, and on average they are sharing passwords for two accounts, with the most common passwords shared being email (59%), social media (44%) and TV/media (16%).

Even though 80% believe it is riskier to share their email password with a friend than lend them their car (20%), half of those sharing passwords do just that.

Norton's tips for online safety include :

Choose a unique, smart, secure password for each account you have online.

Delete emails from senders you don’t know (or senders you know but who don't normally email), and don’t click on attachments or links on suspicious-looking emails.

On social media sites, receiving an offer that sounds too good to be true, might be just that. Beware of the pitfalls of clicking on links from social media sites. Before clicking, hover the mouse over the link to see its destination. Only click on links that lead to reputable, official company pages.

Always monitor your financial accounts for unusual activity. If there is a charge that you didn’t make, report it immediately. Often cybercriminals will charge a small “test” amount before attempting to drain your bank account.

Don’t put off installing security software such as Norton Security and updating it regularly.

Use a secure backup solution to protect files and backup regularly so criminals can’t hold them for ransom. Paying a ransom is no guarantee that you will get the data back,though the argument goes that it is in the interest of the criminal to return the data in order to encourage future payments.

Report cybercrime to the local police or national cyber crime organisation if you have been affected by cybercrime or identity theft.

Interested?

Read the report

*The Norton Cybersecurity Insights Report is an online survey of 17,125 device users ages 18+ across 17 markets, commissioned by Norton by Symantec and produced by research firm Edelman Berland. The margin of error for the total sample is +/-0.75%. The Singapore sample reflects input from 1,009 Singapore device users ages 18+. The margin of error is +/- 3.09% for the total Singapore sample. Data was collected August 25 to September 18, 2015 by Edelman Berland.